maryland earned income tax credit 2020

Anne Arundel County 02 285 Calvert County 05 Cecil County 08 Frederick County 11 300. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the.

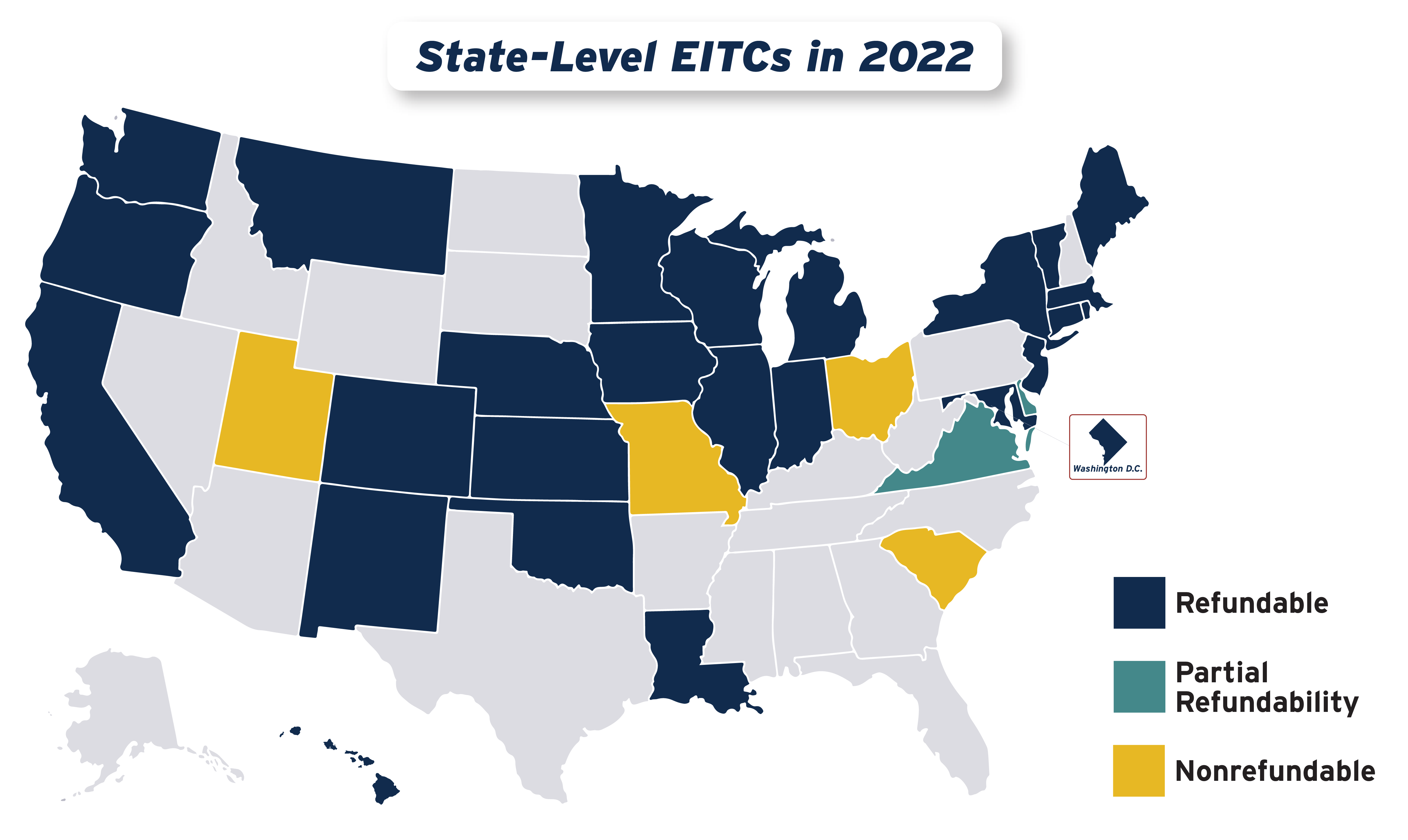

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

. The state EITC reduces the. The program is administered by the Internal Revenue Service IRS and is a major anti. It is a special program for low and moderate-income persons who have been employed in the last tax year.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Eligibility and credit amount depends on your income.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the. The payments provide 178 million in relief to 400000 Marylanders. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the. Ad Guaranteed maximum refund. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC.

State Earned Income Credits Maryland offers a nonrefundable credit which is equal to the lesser of 50 of the federal credit or the State. Learn More at AARP. The expanded Maryland EICs are available in tax years 2020 2021 and 2022.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

The maximum federal credit is 6728. 6 Often Overlooked Tax Breaks You Dont Want to Miss. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

Answer some questions to see if you qualify. In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for. HB 679 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes.

Get your refund faster with free e-filing and direct deposit straight to your bank. If you qualify you can use the credit to. Businesses and Self Employed The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

SB 619 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by increasing. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. Allowing certain taxpayers with federal adjusted gross income for.

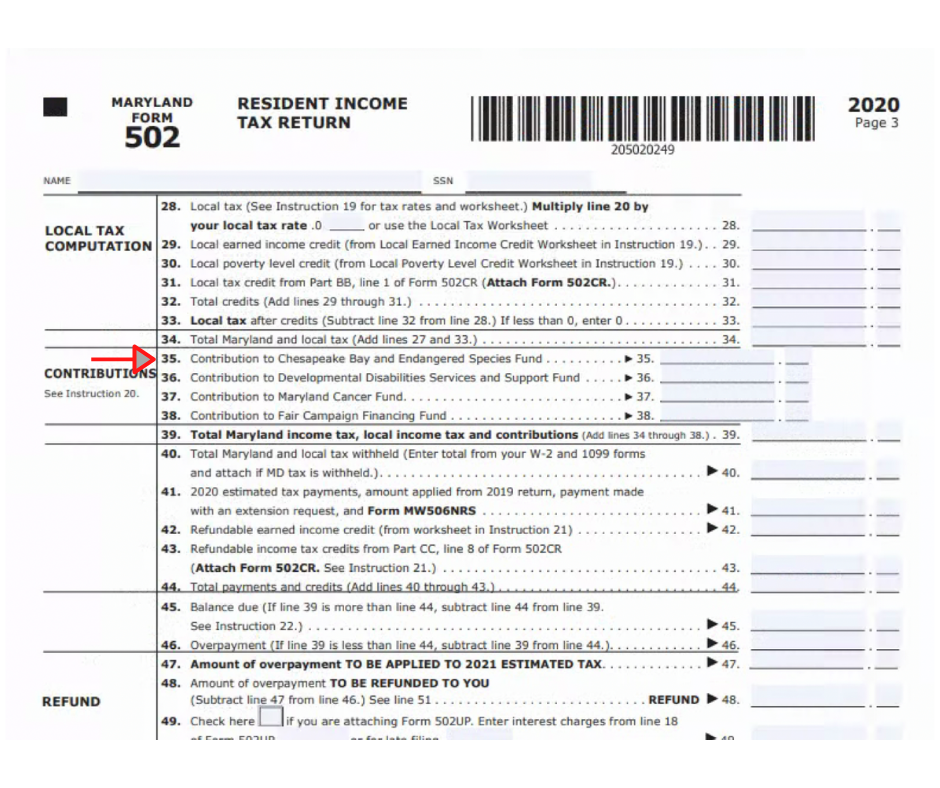

See Worksheet 18A1 to calculate any refundable earned income tax credit. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. Earned income includes wages salaries tips.

Ad Unbiased and Up-to-date Information on All of Our Products and Services. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of. 1 General Info 2 Filing Status 3 AGI 4.

2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers. Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit. E-File directly to the IRS.

Apply to tax years 2020 through 2022. Required to file a tax return.

Among New Maryland Laws Effective Monday Help For Parents Paying Thousands Of Dollars For Child Care Baltimore Sun

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Do State Earned Income Tax Credits Work Tax Policy Center

Maryland Form 502 Maryland Resident Income Tax Return 2021 Maryland Taxformfinder

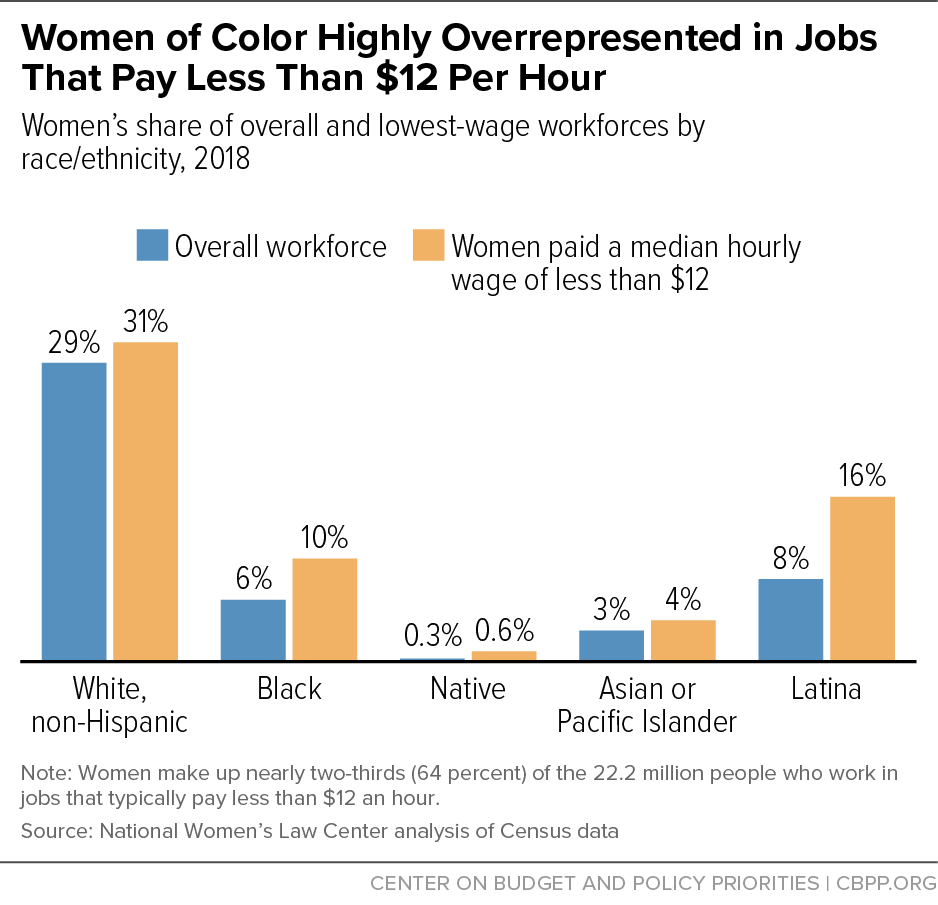

State Policy And Practice Related To Earned Income Tax Credits May Affect Receipt Among Hispanic Families With Children Child Trends

Earned Income Tax Credit Expansion Quietly Becomes Law Maryland Matters

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

How Do State And Local Individual Income Taxes Work Tax Policy Center

Montgomery Council Approves Fy 21 Budget Fy 21 26 Cip Conduit Street

Maryland Paycheck Calculator Smartasset

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

The Effects Of State Earned Income Tax Credits On Mental Health And Health Behaviors A Quasi Experimental Study Sciencedirect

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Maryland Governor Larry Hogan Announces 1 86 Billion Tax Relief Program Hoffman Group

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

Tax Credits Deductions And Subtractions

Maryland Community Action Partnership Rescue And Relief Toolkits